I have been thinking about the long-term impact of high school and college kids finding work during the summer. One thing I think we can do as adults to encourage young adults to work is educate them about how a job is a form of investing in themselves and their future.

Start with talking about saving for retirement. (I know, what could be less interesting to kids than talking about retirement!) One important piece of information to highlight is that there is a special account designed for them with many special benefits: we are talking about a Custodial Roth IRA. Laugh as you may, but there can be some hidden benefits that would entice any kid to start saving.

Let’s talk about the benefits

- You can save up to the lesser amount of either earned income (i.e. W-2 wages) or $6,000 in 2021.

- Parents can make contributions to a custodial Roth IRA on behalf of their children as long as the total contribution, both parent and child, remains at the lesser amount of either earned income (i.e. W-2 wages) or $6,000 in 2021.

- The money goes into the account after taxes are paid, but the child typically has a 0% tax rate. And the interest earned or capital gains on the Custodial or regular Roth IRA are never taxed.

- Once the account has been open for 5 years, the principal can be taken out without penalty. The earnings have to be left in the account or there will be a 10% penalty due. The 5-year rule is based on a calendar year. If the Roth is open on December 31st of 2021 on January 1st, 2026 the 5-year rule has been met.

- While it is expected that 20% of children’s assets are to be used each year to pay for college expenses each year when applying for financial aid via a FAFSA (Free Application for Student Aid) application, retirement assets are not included for either adults or student.

Ways to discuss the benefits and teach financial concepts

- Help them to set up a budget to determine how much they can save. Calculate what their expected earnings are, what are reasonable expenses and do they need additional money during the school year to pay for books or pizza.

- Take the opportunity to teach them about investing, such as:

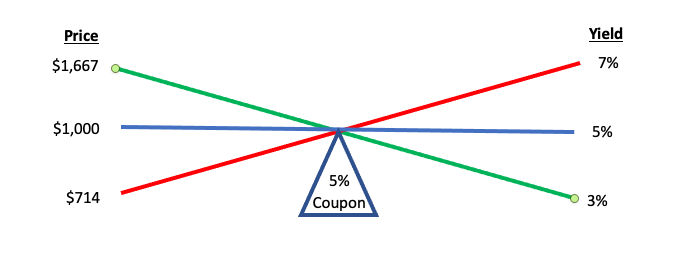

- the difference between a stock (ownership in a company) and a bond (lending to an entity);

- the difference between a mutual fund (a group of stocks and/or bonds) and an ETF, Exchange Traded Fund, (a group of stocks and/or bonds that follow an index);

- the risk of declining or increasing in value; and

- the average on the S&P 500 (an index of 500 large capitalized firms) average annual market return is still 10% over the last 300 years.

- Take them to a meeting with your financial advisor and have them explain the markets, and how to select a stock, bond, mutual fund or ETF as their first opportunity to invest. Alternatively, have them pick a company that they like or use their products, or think is cutting edge and let them buy that company’s stock.

- Offer to match what they put in as an incentive or gift them the first $100 to get them started.

- The 5-year rule is important simply because the money that is put into the account may be available to help pay student loans, put a down payment on a first apartment or the down payment on their first home. Meanwhile the remaining earnings in the account can continue to grow.

- And best of all, if they leave the money alone, they will have a great start at funding their retirement. Say they are going to be a senior in high school, if they invest $500 over the next 4 years, a $2,000 investment at an average annual return of 10% they will have $186,000 at their full retirement age of 67. This also brings up the chance to teach the Rule of 72, take the number 72 and divide it by the expected return on your investment and the answer will tell you how long it takes for your money to double. An example, if your expected return is 10% take 72/10=7.2, in 7.2 years your money will double in 14.4 years you will have 4x what was originally invested and in 21.6 years you will have 8x the original investment and that is without contributing a penny more. The joy of compounding!

As adults, we can make it fun for your children and young adults to see the benefits of saving money for future needs, whether it is retirement or a down payment on a home. It provides future freedom from financial worries and the ability to reach their goals.