Recently, someone asked me “How do you value a bond?” I thought others may have the same question.

First, we need to understand what a bond is. A bond is similar to a loan: you are lending an amount of money to a corporate or government borrower, who then issues you a bond. The issuer promises to pay you interest semi-annually and pay the principal back at maturity. When looking at the value of the bond, there are five important questions which need to be asked.

- What is the face value of the bond, i.e., what is the “par” value of the bond?

- What is the interest rate that the bond states it will pay, i.e., what is the “coupon” rate?

- When does it mature?

- Can the bond be paid off early, i.e. is it “callable”?

- What is the current yield on a similar type of bond of equal quality?

While the first four questions will give us a sense of the technical parameters of my bond, the question of current yield varies with the market and requires we do more analysis.

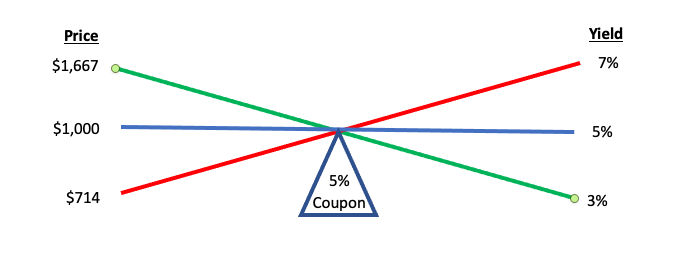

Let’s use an example to explain. I own a $1,000 bond that pays a 5% interest rate (coupon), matures in 10 years and cannot be paid off early (non-callable). If current yields on a bond similar to mine are 5%, the value of my bond is $1,000.

But what if current yields are higher or lower?

If a current yield on a similar bond is 3%, the value of my 5% bond is higher than the face value because my bond has a higher return. Let’s walk through it:

- My 5% bond is paying me $25 semi-annually for a total of $50/year, while current 3% bonds are paying $15 semi-annually for a total of $30/year.

- If I were to reinvest that $1,000 in a new bond, I would only receive a 3% annual yield. Therefore, I would want to sell that bond for more than $1,000 value it states on the bond (par), so I can reinvest my money to get the equivalent of my 5% return.

- Thus, I would sell it for $1,667 so that if I reinvested that money at a 3% current return, I would receive an interest payment of $25 semi-annually and $50 annually.

Similarly, if current yields increase to 7%, no one would want my 5% bond because the returns on my bond would be lower. I would have to sell it at a discounted value compared so that the person buying it would receive a yield of 7%.

A good way to think about the value of a bond is a teeter-totter. The chart below shows the value of my bond in different yield environments.

Now, what if we change some of the other technical parameters of the bond?

If my bond was callable prior to maturity, a buyer would have to evaluate whether it is likely that the bond would be paid off, or “called” by the issuer prior to its maturity date. This means that the issuer pays the principal amount of the bond prior to its maturity and then stops paying interest. Think of your mortgage, if current yields are lower than when you financed your mortgage, you would probably refinance your mortgage to pay a lower interest rate. In some circumstances, an issuer has a bond that has the option to pay it off early (callable), they may choose to issue new bonds at a lower coupon and pay off the higher coupon bonds. In the previous example, we were calculating how much I would pay if the bond continued paying its coupon until the maturity date. If there is a possibility of paying the bond off early, I would figure out the price of it to the earliest day it can be paid off (call date) rather than its maturity date.

Another type of bond is a zero-coupon bond. These are typically offered by the Treasury Department but can be issued by any issuer. These bonds do not pay any interest during the holding period, i.e. zero interest. Therefore, I would purchase that bond at a discount based on current yields. If current yields were 5%, and it will pay $1,000 upon maturity 10 year from now, I would buy it for $610, which would provide me a yield of 5% on the money I invested.

Another issue affecting a bond would be the quality of the issuer of the bond and from what funds will it be paid. If I purchased a bond from a high-quality issuer which eventually erodes its ability to pay the bond at maturity, the value of that bond would drop. I would need to receive a higher yield to take on the risk of the issuer.

There can be many market conditions that can affect the value of the bond, but if you can answer the above 5 questions, you will be able to determine the current value at any point of time.